Medical expense deduction free#

Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state).Make an Appointment with one of our tax pros today. Have additional questions about deductions for medical expenses or need help filing your return? Our Tax Pros speak the tricky language of taxes and are committed to helping you better understand your taxes. To learn more, see Publication 502: Medical and Dental Expenses at Questions about medical expense deductions? Medicare tax on wages and tips paid as part of the self-employment tax or household employment taxes.Cosmetic surgery not related to any of these:.What are some expenses not considered deductible medical expenses?

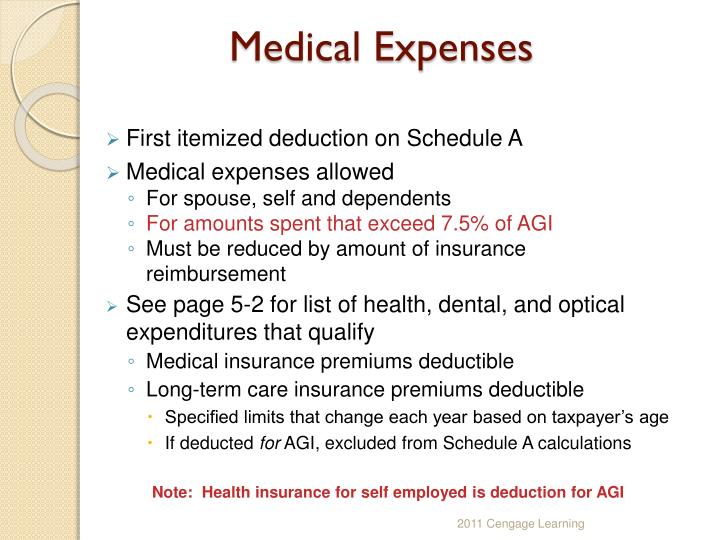

Has a gross income that’s more than $4,300.Would qualify as your dependent except that person:.You can also deduct medical expenses you pay for any other person who: This applies even if your former spouse claims your children as dependents. If you’re divorced, you can deduct any qualifying bills you pay for your children as a medical expense. You can deduct medical expenses for anyone who qualifies as your spouse or dependent when either: Whose medical expenses can I include on my return? Credit card - the date the charge is made, not the date you pay the credit card bill.Online or phone - the date reported on the statement showing when you made the payment.Payment by check - the day you mail or deliver the check.The payment dates for expenses paid by the following methods are as follows: It doesn’t matter when you received the services. You can include only the medical and dental expenses you paid in the current tax year. If you’d like to learn more about HSAs, see Form 8889 instructions at Are medical expenses deductible in the year paid or incurred? Medical expenses paid with HSA distributions are not deductible. Otherwise, contributions are deducted “above-the-line” as adjustments to income. For employer-sponsored plans, HSA contributions are made pre-tax. Pay a flat amount for the loss of a limb or eyesightĬontributions you make to a health savings account (HSA) aren’t medical expenses.

Transportation costs to and from medical care.Cost of medical care from any of these types of practitioners:.You can’t deduct expenses that simply benefit general health, like vitamins or a vacation. If you want to deduct medical expenses, they must alleviate or prevent a physical or mental defect or illness. Items needed for the above purposes, including:.What medical expenses can I deduct?įor any medical condition, it includes the unreimbursed cost of: To understand what costs are covered as a deduction, read on. Review changes to medical expense deduction from tax reform.

0 kommentar(er)

0 kommentar(er)